The RSPU ETF has attracted considerable scrutiny from portfolio managers seeking exposure to the thriving North American stock scene. Evaluating its historical performance, however, requires a comprehensive approach.

While the ETF has generally performed positive returns over the long term, interpreting its weaknesses is crucial for traders to make intelligent allocations.

A in-depth review of RSPU's portfolio composition reveals a diversified approach that aims to mirror the movements of the broader stock index. This design can provide investors with a moderately low-risk platform for exposure in the Canadian stock scene.

Nonetheless, it's essential to consider the volatility associated with any asset class. Understanding variables including economic conditions is critical for traders to make prudent investments.

By conducting a comprehensive evaluation, traders can gain clearer perspective into the performance of the RSPU ETF and make strategic allocations.

Discovering Potential: Equal-Weight Utilities with RSPU

The utility sector often presents a varied landscape, offering both growth and reliability. Investors seeking to leverage this opportunity may consider an equal-weight approach. By distributing capital fairly across utilities, investors can mitigate the impact of any single company's performance. The RSPU index provides a thorough framework for implementing this strategy, ensuring exposure to a broad range of utility companies.

Allocating in RSPU ETF for Steady, Defensive Gains

In today's fluctuating market, investors are constantly searching for ways to earn steady returns while controlling risk. The RSPU ETF presents a compelling opportunity for those seeking a diversified portfolio that focuses on resilient growth. This investment vehicle tracks a meticulously curated index of corporations known for their reliability. By putting money in RSPU, investors can hopefully enjoy consistent returns even during periods of market uncertainty.

- Additionally, the ETF's focus on defensive sectors provides a degree of safeguard against market downswings.

- In conclusion, RSPU can be a valuable addition to any established investment strategy seeking both development and stability.

RSPU Fund Performance

The utility sector remains a steadfast mainstay of check here many investors' allocations. The RSPU ETF, a popular vehicle for gaining exposure to this sector, has delivered mixed returns in recent years. Understanding the factors shaping the utility landscape is crucial for individuals looking to navigate on these shifts. Furthermore, staying aware of key metrics such as dividend yields can provide valuable guidance for making strategic investment decisions.

- Consider the dynamics driving current performance in the utility sector.

- Assess the performance of the RSPU ETF over diverse time periods.

- Spread risk across multiple asset classes to reduce portfolio risk.

Examining the RSPU ETF's Performance

The RSPU ETF has attracted considerable interest from investors seeking growth in the real estate sector. To understand its suitability, a detailed review of its past performance is crucial. Assessing key metrics such as yield over various cycles can reveal valuable understanding into the ETF's potential. Furthermore, comparing its performance to relevant indexes can illuminate its competitive standing.

Should You Consider the RSPU ETF for Your Portfolio?

The RSPU ETF has captured the attention of many investors seeking a diversified approach to the market. Nevertheless, before you add it to your portfolio, it's important to understand its advantages and weaknesses. This ETF tracks an index that focuses on large-cap companies in the U.S., offering potential for steady growth. Additionally, RSPU provides exposure to a range of sectors, helping to mitigate risk. But it's not without its drawbacks, such as fees.

- Ultimately, the decision of whether or not the RSPU ETF is right for you depends on your individual retirement plans and risk tolerance.

Tony Danza Then & Now!

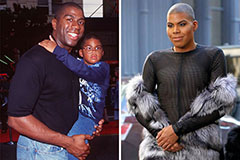

Tony Danza Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Erika Eleniak Then & Now!

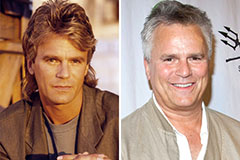

Erika Eleniak Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!